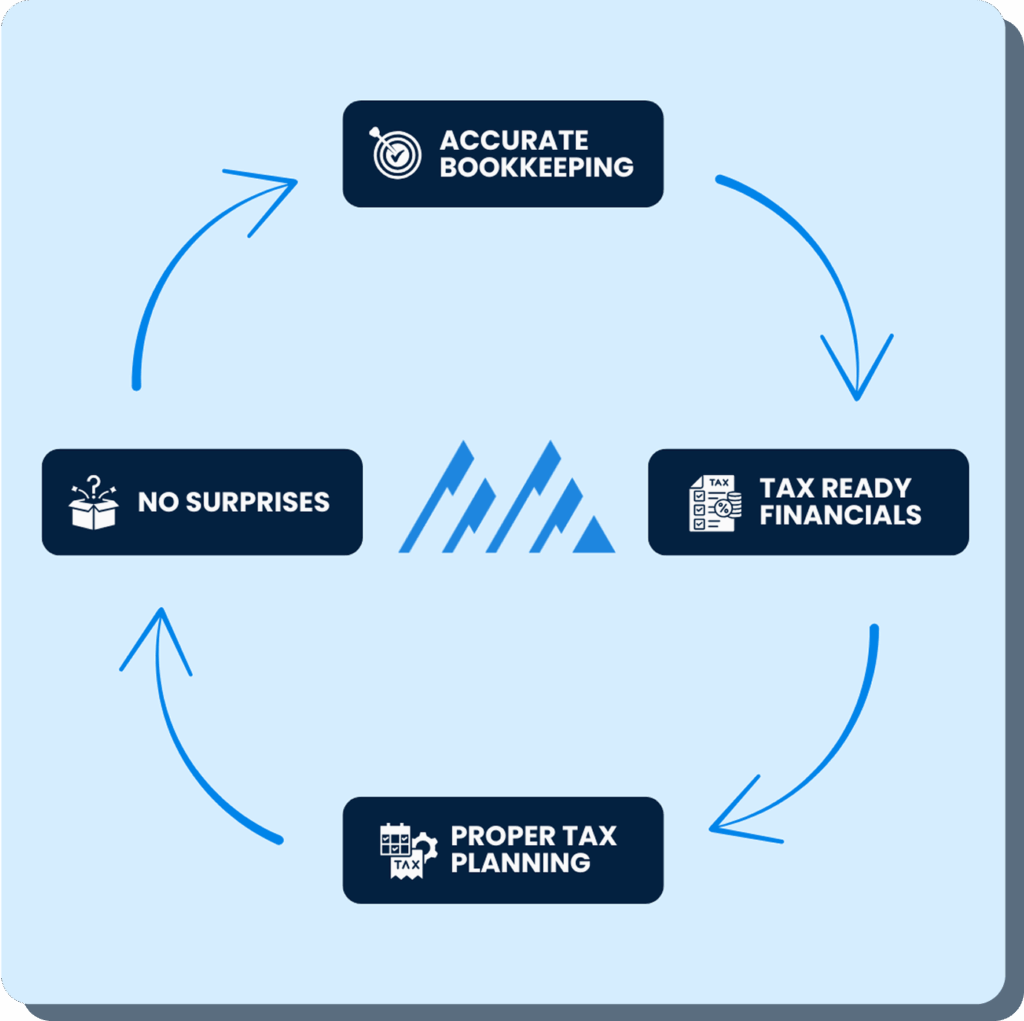

Business Tax Compliance and Preparation

No more unexpected tax bills. Get clarity, control, and confidence.

Business owners shouldn’t be surprised come tax season. At Milks CPA, we help you stay ahead by tracking profits and taxes year-round. No last-minute surprises, just clear numbers and smart planning.

Stay Ahead, Not Behind on Taxes

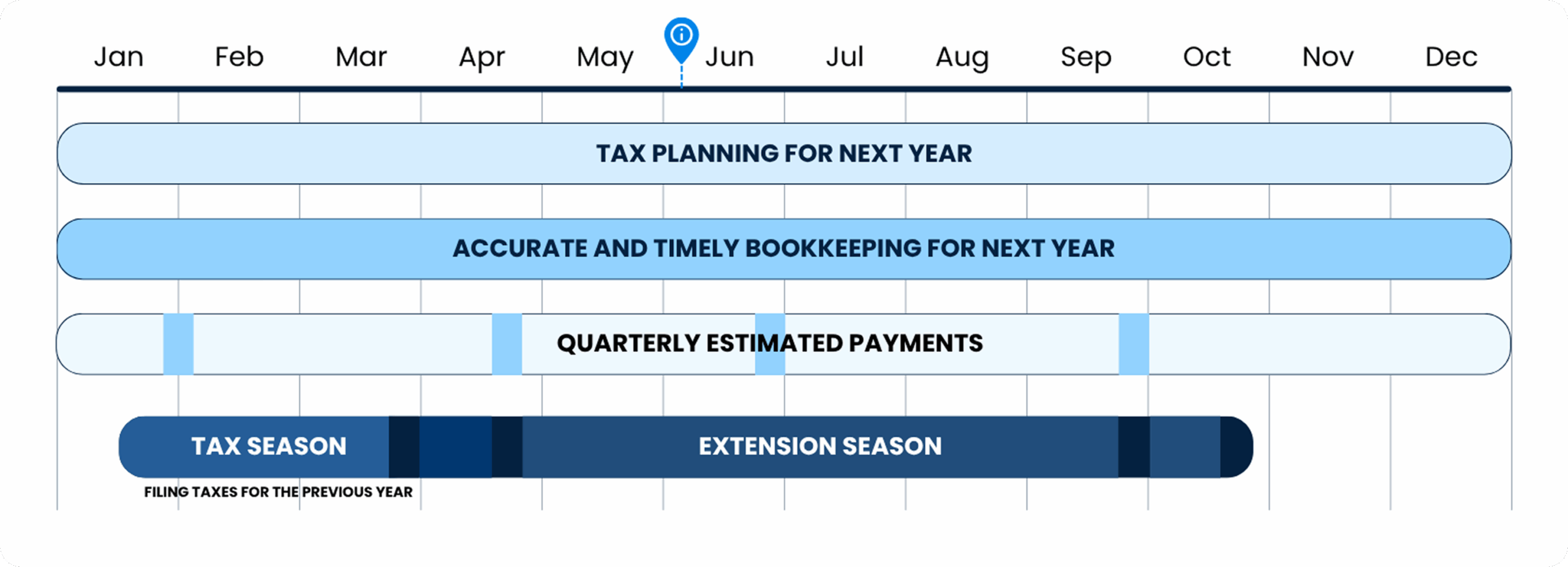

Real tax savings happen while the year is still in progress not after it ends. Filing season only reports what already happened which is why planning ahead is essential. A strong tax plan helps you make timely moves that actually lower what you owe.

Mid-year is a key checkpoint in your tax planning journey. It’s the ideal time to revisit past returns for possible amendments, evaluate new strategies before filing, and prepare for future tax years. This period also gives us clearer insight into current and upcoming tax law changes that could affect your situation.

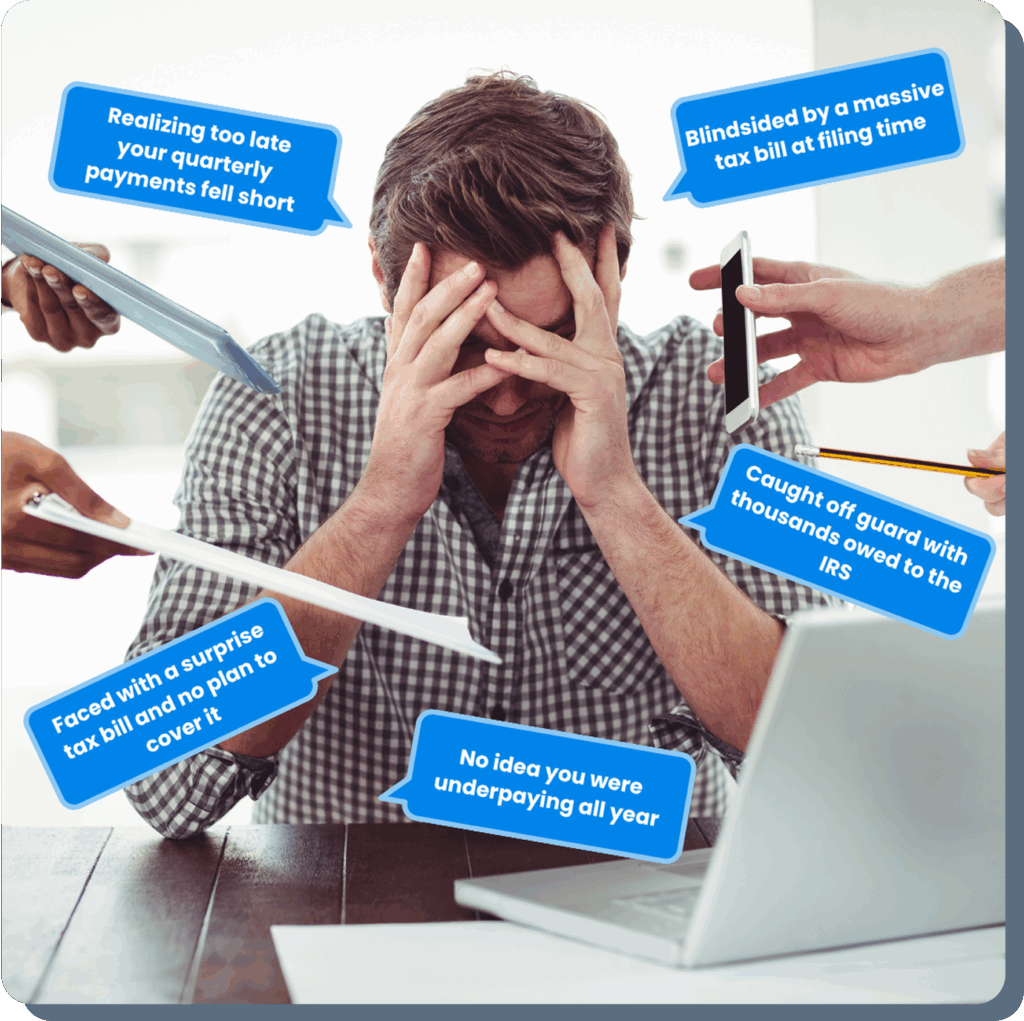

Unexpected Tax Bills? Not with Milks CPA

We believe tax time shouldn’t come with surprises. At Milks CPA, we keep you informed year-round about your business performance and how it affects your taxes. With proactive planning and accurate quarterly estimates, you avoid large balances due—or overpaying and giving the IRS an interest-free loan.

The Power of Being Prepared

Being prepared doesn't mean predicting the future—it means understanding how today’s decisions impact your tax position tomorrow. At Milks CPA, we help you minimize tax season stress by giving you clarity year-round. From real-time business performance reviews to tax planning strategies, we keep you informed and ahead—so you’re never caught off guard.

Bookkeeping That Drives Better Tax Decisions

Accurate and timely bookkeeping is the foundation of your tax return. When you stay in tune with your financials throughout the year, you gain visibility into your tax position—before it’s too late to make adjustments. With clean, reliable books, we can help you identify opportunities, avoid surprises, and deploy tax-saving strategies that actually work. At Milks CPA, your books aren’t just numbers—they’re tools for smarter decisions.

Accurate Books Are Just the Beginning

Being prepared doesn't mean predicting the future—it means understanding how today’s decisions impact your tax position tomorrow. At Milks CPA, we help you minimize tax season stress by giving you clarity year-round. From real-time business performance reviews to tax planning strategies, we keep you informed and ahead—so you’re never caught off guard.

That’s why at Milks CPA, we help you navigate key areas like:

- Preserving your S-Corp Election

- Tracking Cap Table Changes

- Maximizing Bonus Depreciation

- Managing State Tax Obligations

- Handling Foreign Tax Reporting

- Maintaining Shareholder Basis Schedules

We make sure your return reflects strategy, not just compliance.

What They Say