Business Tax Advisory

Tax Strategies That Actually Save You Money

Many CPA firms do not have the time, tools, or systems to offer real value through tax planning. At Milks CPA, we take a more proactive approach with a clear tax strategy and regular check ins throughout the year to help you reduce and delay your tax burden the smart way.

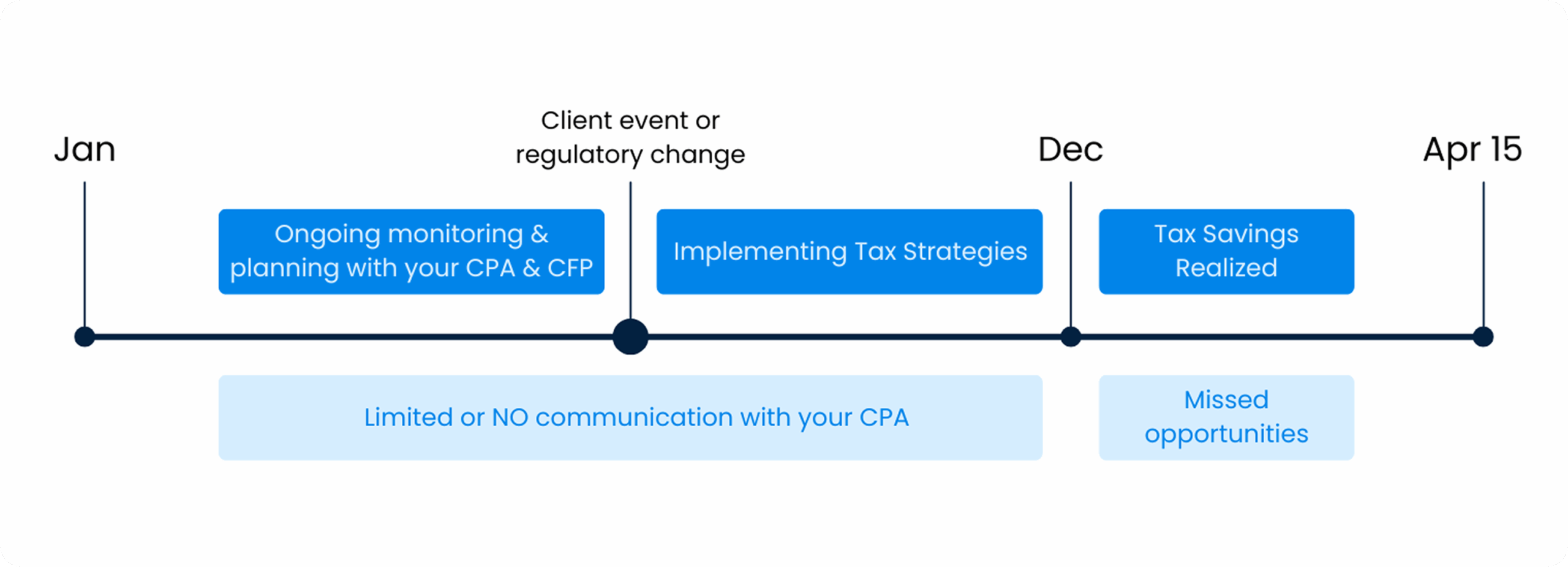

Proactive VS Reactive Tax Advisory

Proactive tax planning means your CPA works with you throughout the year, helping you find ways to save before important deadlines. Reactive tax advice only comes during tax season, often offering rushed or basic suggestions when it is already too late to make changes. With proactive planning, you stay ahead instead of scrambling at the last minute.

Proactive Advisory CPA - Frequent Touch Points

A proactive CPA stays in touch with you throughout the year and works closely with other experts, like a Private Wealth advisor, to suggest tax-saving strategies early enough for you to take action before the year ends.

Reactive CPA - Limited / No Touch Points

A reactive CPA often misses important changes in your finances or tax laws that affect you because they are too busy handling tax returns for others and dealing with ongoing pricing and staffing problem

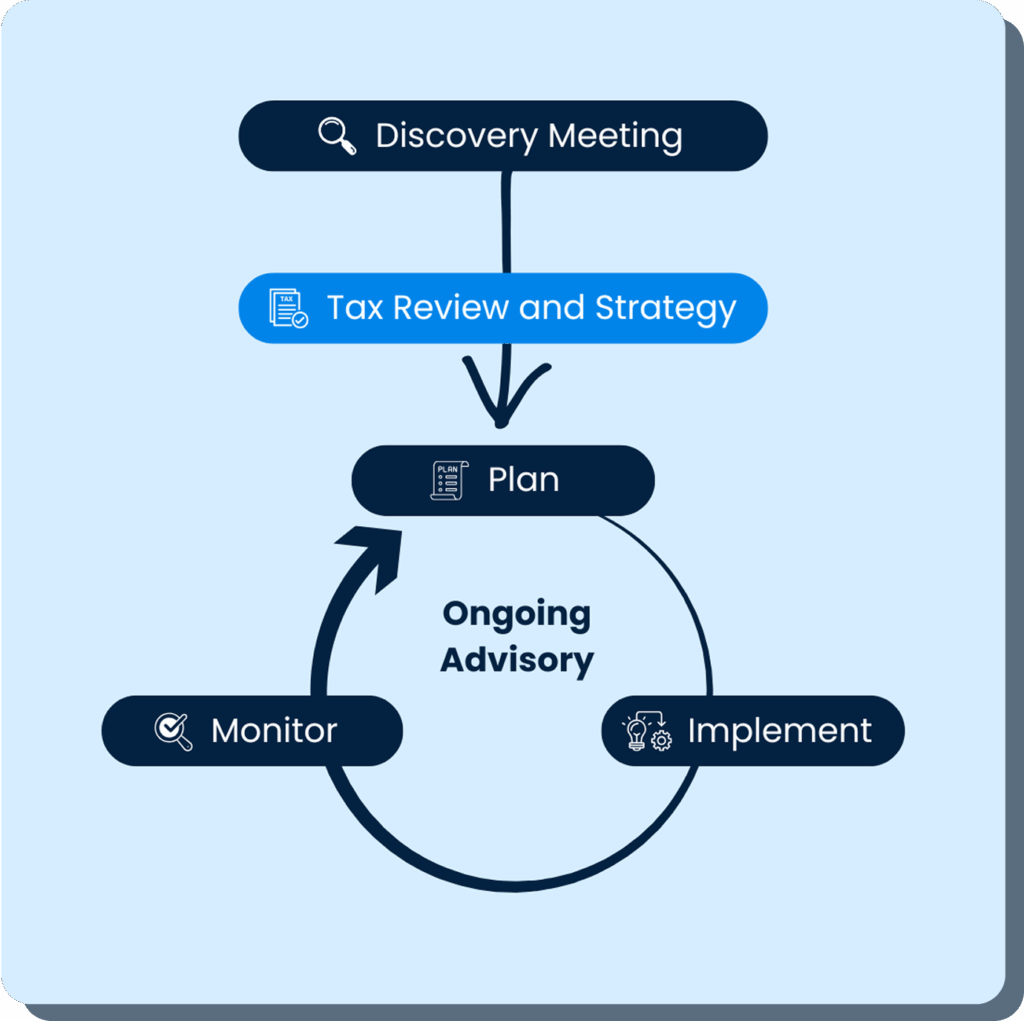

The Tax Advisory 3-Step Process

1. Discovery Meeting - We start with a conversation to fully understand your current and past tax situation, along with your future goals.

2. Tax Review and Strategy – Using the details from our meeting, your CPA prepares a personalized plan with tax strategies that fit your needs and show how they can benefit you.

3. Plan and Follow Through – Together, we create a clear step-by-step plan and timeline to carry out your chosen strategies. We make sure everyone knows their role and stay updated on any changes in tax laws or your situation.

Tax Strategies That Actually Pay Off

Our goal is not to cancel out your tax savings with high fees. We help you weigh the cost of each tax strategy against its potential savings. In the end, our strategic tax planning is meant to leave more money in your pocket. That is why we include the estimated return on investment in your Tax Assessment and follow up with actual results when it is time to file.

Your Personalized Tax Roadmap

You should not be left guessing which tax strategies apply to you or feel caught off guard during tax season. Our goal is to explore all possible options that fit your situation. Some strategies take more time or cost to implement, so it is important to understand each one before making a decision. The Tax Assessment gives us a full picture of your current standing and helps identify the most relevant strategies. From there, we create a proposal focused on the actions that can make the biggest impact.

Business Tax Advisory

Frequently Asked Questions

What is Tax Strategy/Advisory and how can it benefit me or my business?

Tax advisory provides expert guidance on tax matters to help ensure compliance, reduce liabilities, and uncover savings opportunities. It supports businesses by improving tax efficiency and reducing exposure to risk. Since many strategies are specific to a client’s circumstances, proper implementation often requires specialized knowledge and experience.

What is a Tax Assessment?

A tax assessment is a professional review of your financial records by a Certified Public Accountant to evaluate your tax obligations and identify opportunities to minimize liability. It ensures accuracy, compliance, and strategic tax planning.

How can Tax Strategy/Advisory services help in reducing my tax liability?

Tax strategy and advisory services help reduce your tax liability by identifying deductions, credits, and planning opportunities tailored to your situation. They ensure you stay compliant while keeping more of what you earn.

What is the difference between Tax Deferral Strategy and Tax Reduction Strategy?

A tax deferral strategy delays when you pay taxes, allowing your money to grow or be used longer before taxes are due. A tax reduction strategy permanently lowers the total amount of taxes you owe.

What is the difference between Tax Compliance and Tax Strategy/Advisory?

Tax compliance focuses on accurately filing your returns and meeting all IRS and state requirements on time. Tax strategy and advisory go beyond compliance by proactively planning to minimize taxes and align with your financial goals.

How do Tax Advisory stay updated with changing tax laws?

Tax advisors stay updated with changing tax laws through ongoing professional education, industry research, and monitoring IRS and state updates to ensure clients remain compliant and benefit from new opportunities.

What documents and information do I need to provide to a Tax Advisor?

You’ll typically need to provide prior tax returns, income statements (W-2s, 1099s), expense records, and any documents related to deductions, credits, or investments. Your tax advisor may also request additional information specific to your situation.

Are the fees for Tax Advisory services tax-deductible?

Tax advisory fees for personal tax planning are generally not deductible, but fees related to business, investment, or rental activities may qualify as deductible expenses. It depends on your specific situation.

What They Say