Personal Tax Strategy

Tax Strategies That Build Your Future

Whether you’re growing a business, increasing your wealth, or creating a legacy, we help you leverage the tax code to build smarter and stronger. We serve entrepreneurs, the affluent, and the ambitious—at every stage of their journey. As you progress, we’ll ensure you have the right experts working together to protect what you’ve built and position you for lasting success.

The Builder’s Journey with Milks CPA

When you’re building wealth, every step counts. As your income grows, your financial decisions have a bigger impact—and the opportunities (and risks) multiply.

You wouldn’t take tax or investment advice from a random social media post. But hiring just any professional isn’t enough either. It’s rare to find a great CPA and a great CFP who actually work together for your benefit.

At Milks CPA, you get both—plus a cohesive team that understands your goals, strategizes with you, and helps you navigate every stage of growth.

As your journey unfolds, you’ll see more of us by your side. We promise not to be too annoying.

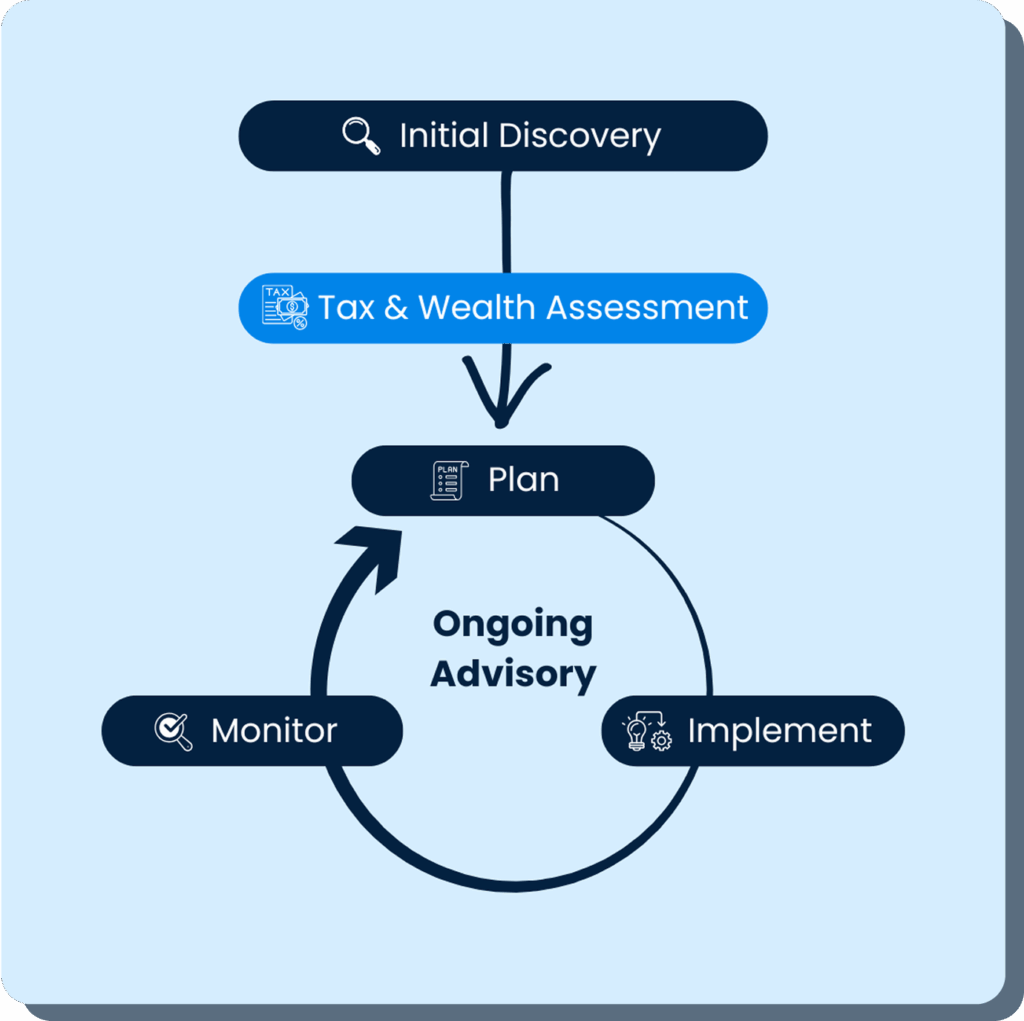

The Tax Advisory 3-Step Process

1. Initial Discovery- We start by reviewing your current tax position and identifying any upcoming changes or opportunities that could impact your finances.

2. Tax & Wealth Assessment – Using the insights from discovery, we create a tailored proposal outlining tax-saving strategies and investment options, complete with their potential returns.

3. Ongoing Advisory – We set a clear timeline to implement your chosen strategies, keep all parties aligned, and adjust the plan as tax laws, market conditions, or your goals evolve.

Your Trusted CPA Partner for Stress-Free Finances

From tax preparation to strategic business planning, we handle the numbers so you can focus on growing your business. At Milks CPA, we deliver accurate, timely, and personalized accounting solutions to keep your finances on track and your goals within reach.

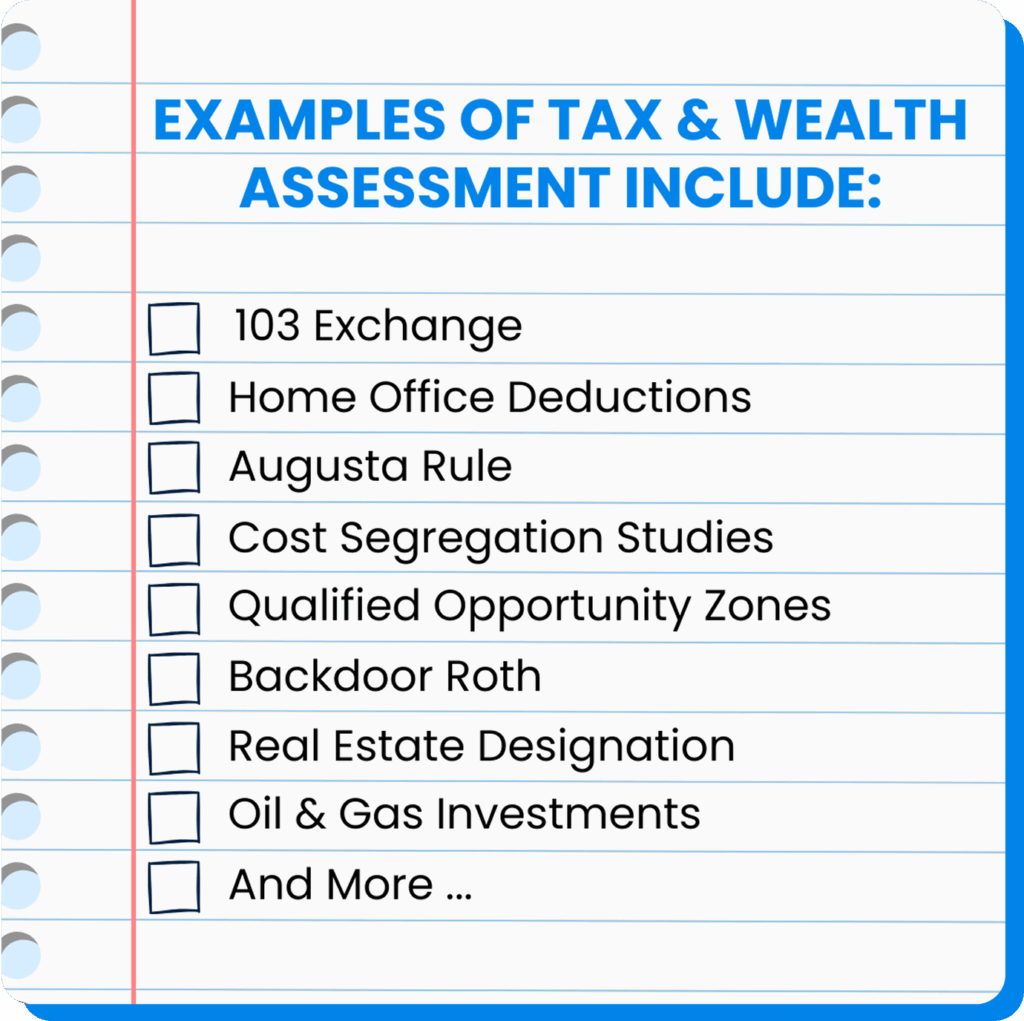

Tax & Wealth Assessment

Clarity in Tax & Wealth Planning

With countless tax-saving ideas and investment paths out there, it’s easy to feel overwhelmed. Our Tax & Wealth Assessments cut through the noise, focusing only on the strategies that fit your unique situation. For each opportunity, we outline the cost, timeline, and steps needed to put it into action—giving you the insight to make confident, informed decisions. And we don’t just stop at recommendations; we ensure your chosen strategies move from paper to real-world results. This single assessment combines our tax expertise and wealth planning into one clear, actionable plan.

Tax & Wealth

Frequently Asked Questions

What is tax strategy, and how is it different from tax preparation?

Tax preparation is about filing accurate returns, while tax strategy focuses on proactive planning to minimize your tax burden and align your finances with your long-term goals.

How can a tax strategy benefit my business?

A tailored tax strategy can help reduce your tax liability, improve cash flow, and free up capital to reinvest in growth—all while staying compliant with tax laws.

When should I start implementing a tax strategy?

The best time to start is before tax season—ideally year-round—so you can make informed decisions and take advantage of deductions, credits, and planning opportunities.

What They Say