Personal Tax Compliance and Preparation

Strategy, Clarity and No Surprises

Join Milk’s CPA Network and tap into high-converting offers designed to help you earn more. With competitive payouts, trusted tracking, and a wide range of niches, we make it easy for affiliates to grow their income while working with reliable partners.

Tax Planning Built In

At Milks CPA, tax planning is part of the process—not an afterthought. We review your income, deductions, and payments during the year to keep you on track for a near zero balance at tax time. Along the way, we may uncover tax-saving opportunities and recommend strategies designed to deliver a strong return on investment.

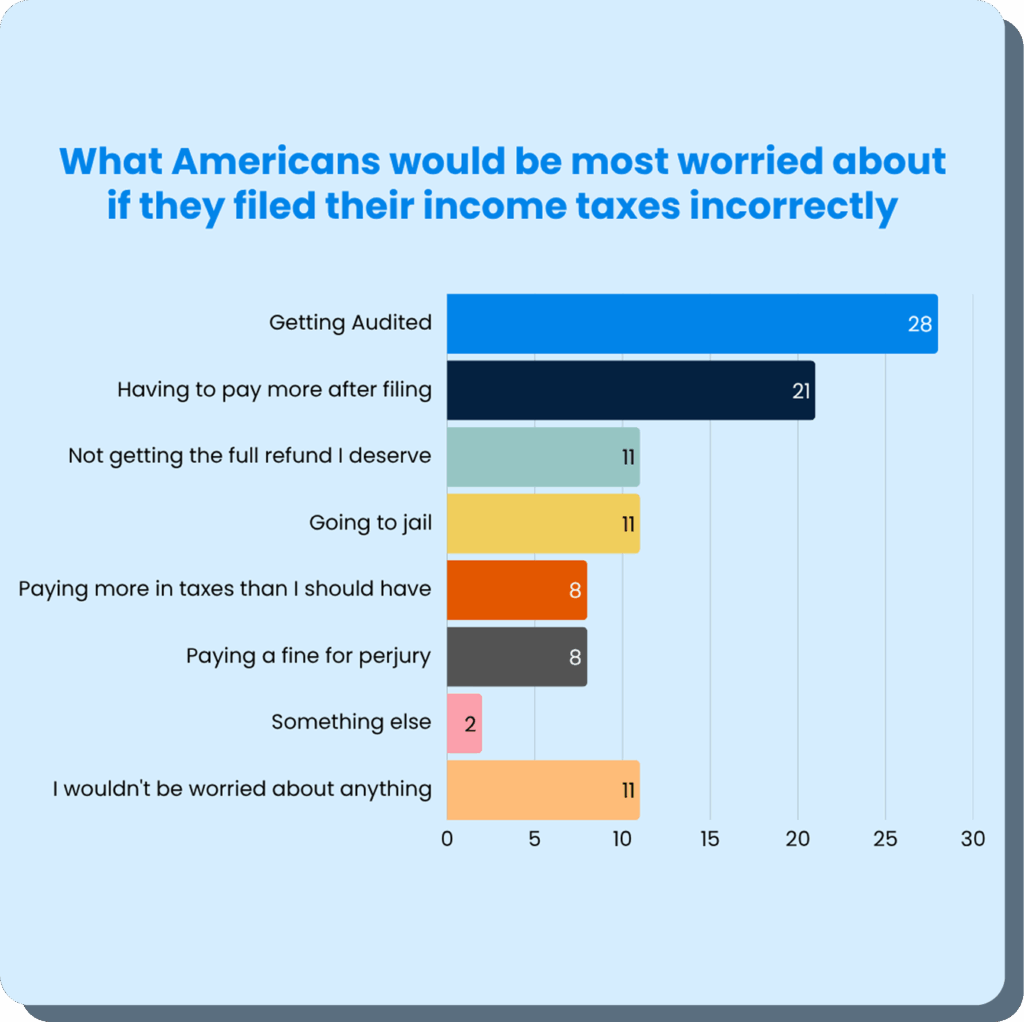

Audit Protection You Can Count On

Most people feel uneasy about the possibility of an IRS audit. Even in the best-case scenario, it costs time and money to defend your tax return — and if you owe, additional taxes, penalties, and interest can quickly add up. That’s why every return we file comes with an audit defense insurance policy covering up to $1 million in representation fees, whether the audit comes from the IRS, the state, or both. While we stand by the accuracy of our work, audits can still happen, and we want you protected if you’re one of the few chosen for review.

From Tax Mess to Tax Clarity

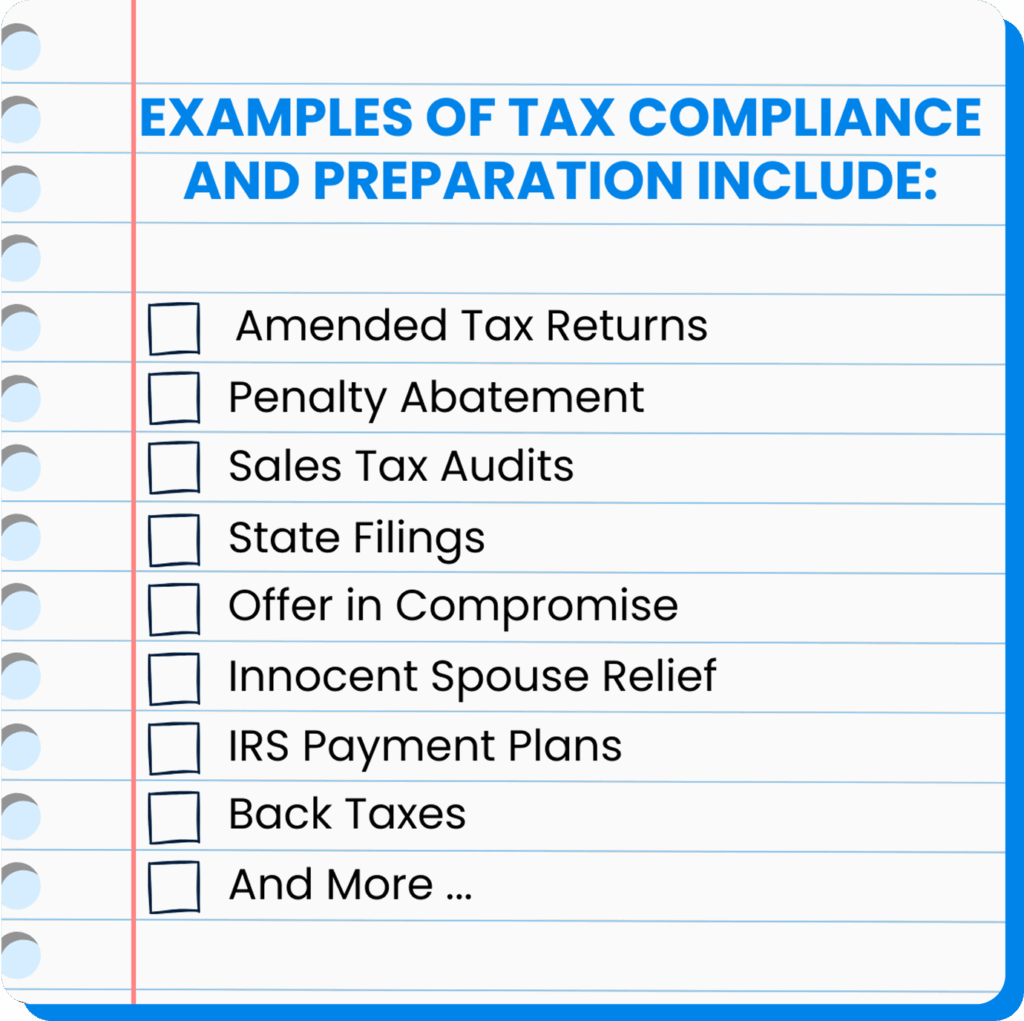

Whether your tax situation is more complicated than you realize or not as bad as you feared, we’ll sort it out. In our initial consultation, we’ll review the documentation you can provide — past tax returns, IRS or state notices, and any other relevant records. After assessing everything, we’ll outline a clear plan to move forward, which may include targeted services to get you back on track and keep you there.

Tax Compliance and Preparation

Frequently Asked Questions

Is it important to find someone local to do my taxes?

Not necessarily—most tax and accounting work can be handled securely and effectively online. What matters most is expertise, accuracy, and clear communication, not physical location.

I need help with my personal taxes, as well as business

Yes, we can handle both your personal and business taxes, ensuring everything is coordinated for maximum efficiency and accuracy. This helps simplify your finances and gives you a complete picture of your overall tax situation.

Is there a meaningful difference between a CPA, EA

Yes, there is a difference—CPAs and EAs are licensed professionals with rigorous training, testing, and continuing education requirements, while unlicensed preparers have no formal credentialing. Choosing a CPA or EA provides greater assurance of expertise, accuracy, and compliance.

I haven’t filed tax returns for a few years

Yes, we can help you catch up on unfilled tax returns by gathering your records, preparing accurate filings, and working with the IRS if needed. Our goal is to get you back in compliance quickly and with minimal stress.

I received a letter from the IRS

Yes, we can represent you in an IRS or state audit, handling communication, documentation, and negotiations on your behalf. Our goal is to protect your interests and guide you through the process with as little disruption as possible.

Can I drop my files off at your office

We’re happy to meet up with you to gather your documents, but most clients prefer our secure digital portal for convenience and faster processing. Either way, we’ll make the process simple and stress-free for you.

Do I need to come into your office to sign documents

No, you don’t need to come into the office—most documents can be signed quickly and securely through electronic signature. This makes the process faster, easier, and more convenient for you.

I tend to forget what exactly

Yes, we offer a tax return review meeting where we walk you through your current return and compare it to prior years. This helps you understand changes, spot trends, and plan more effectively for the future.

I’m not confident that last year’s tax return

Yes, we can review your prior tax returns to check for accuracy and uncover any missed deductions or opportunities. If corrections or amendments are needed, we’ll guide you through the process to make it right.

How much do you charge

Our fees are tailored to the scope and complexity of your needs, and we’ll provide a clear, customized quote upfront. This ensures you only pay for the services that best fit your business.

Do you prepare returns in-person like the brick

We don’t operate like traditional brick-and-mortar tax prep firms—our process is designed to be handled virtually for convenience and efficiency. However, we provide the same level of personalized service and support every step of the way.

What They Say

"As a small business owner, having a CPA who truly understands the challenges I face has been a game-changer. Their proactive advice on tax strategy and cash flow helped us save

thousands and grow more confidently. I finally feel like I have a financial partner I can trust."

Samantha G.Founder, CleanWave Solutions

"I came to them with multiple rental properties and a pile of confusing tax questions. They not only cleaned up years of messy filings but also introduced smart strategies I didn’t know existed. Now my real estate portfolio is structured for maximum tax efficiency."

Brian L.Real Estate Investor

"They helped me navigate complex equity compensation, retirement planning, and multi-state tax filings with ease. Their personalized attention and clarity turned a usually stressful season into a breeze."

Laura S.Tech Executive

"We needed more than just tax prep—we needed a CPA who understands job costing, payroll, and project-based accounting. This team delivered. They feel like an extension of our business and are always one step ahead."

Miguel R.Owner, Ridgeway Builders

"Starting my business was overwhelming, but their guidance on bookkeeping, tax setup, and quarterly filings gave me peace of mind. I sleep better knowing they’re keeping me compliant and helping me build a solid foundation."

Alicia D.Owner, Bloom & Press Studio

"As an agent, my income can fluctuate wildly. They helped me budget smarter, set up an S-Corp, and taught me how to maximize deductions. Their real estate knowledge is second to none."

Jason T.Realtor

"We’ve worked with several CPAs over the years, and none have been as thorough or responsive. Whether it’s helping us with college savings plans or understanding the tax implications of a home sale, they’re always there to guide us."

Heather and David M.Personal Clients

"Sales tax, inventory, multiple platforms—it’s a lot. But this firm got everything under control fast. I can finally focus on growing my brand without dreading tax season or financial reporting."

Eli P.Owner, Driftwood Goods